HEARTLAND PARK OWNER INTENDS TO CLOSE TRACK IF HIS APPEAL FAILS AGAINST SHAWNEE COUNTY

Payne in the article by Tim Hrenchir says he intends to close the racing facility if his appeal fails in his lawsuit against Shawnee County over a years-long tax battle.

Payne said that in an email last week to The Capital-Journal.

"We anxiously await the State Appellate Court decision to allow us our day in court with trial by a jury of our peers," he said. "If that appeal is not successful, then the course has been set. As a practical matter, it may have been set already. As our counsel has previously said, the die has been cast."

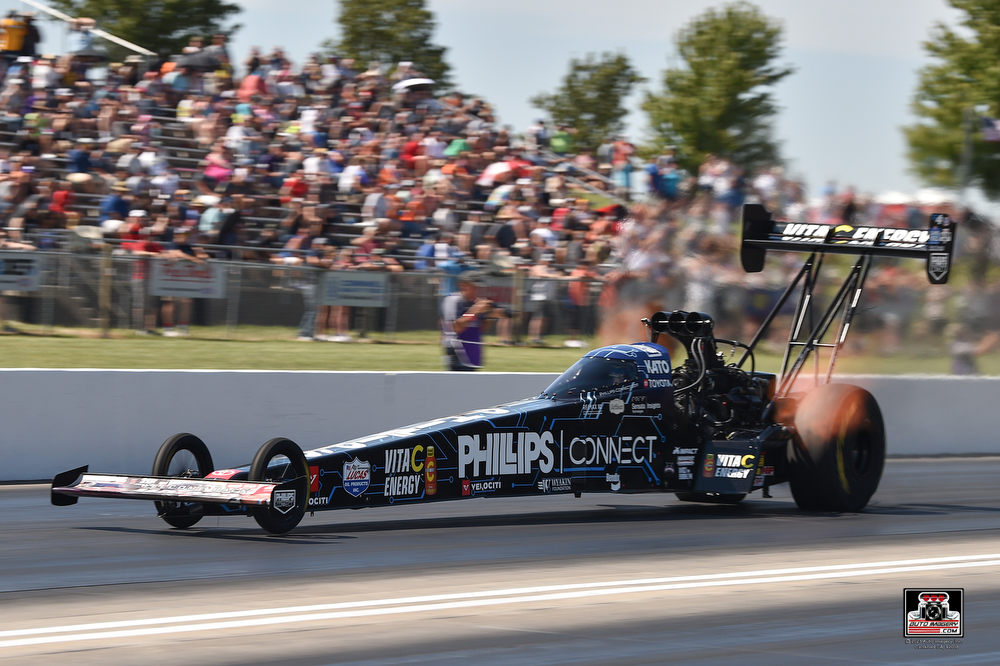

Heartland Park is scheduled to host the Menards NHRA Nationals presented by Pet Armor, Aug. 11-13.

Shawnee County officials say the taxes assessed to the property are appropriate, and the courts so far have taken their side.

After county Commissioners Kevin Cook, Aaron Mays and Bill Riphahn expressed their support for the racing facility May 18, Payne — the owner of Shelby Development LLC, which owns Heartland Park — on May 19 described their statement as being "a shallow gesture to cover their tracks."

Kansas law keeps commissioners' hands tied from getting involved and cutting a deal with Payne, commissioners said in Thursday's statement.

They quoted a Kansas law that says the county cannot "release, discharge, remit or commute" past tax liability if the valuations involved have not been appealed or challenged by the taxpayer.

"We are legally bound by the process set forth in Kansas law for the way to go about that," they said.

Payne replied Friday, "We remain of the opinion that all of the years of the valuation may be resolved by the settlement of the pending case."

Payne said he's been involved for more than 30 years primarily in commercial property ownership and management. He did own Kansas City International Raceway, a drag strip that closed in 2011 at Kansas City, Mo.

Payne said since 2019, he has co-owned one other racing facility: I-70 Motorsports Park, an oval dirt track in Odessa, Mo., just east of Kansas City, Mo.

The property taxes paid on I-70 Motorsports Park are "high" but "appropriately assessed," Payne said.

He added, "We recently sold 158 acres adjacent to the facility to an individual who is going to build a drag strip."

"Shelby and staff have successfully owned and operated Heartland for seven years unlike previous owners," Payne said in the article.

He said he paid the track's property taxes for 2016 but hasn't paid them since.

As of April 26, county records showed Shelby Development owed the county $2,622,996.56 in delinquent property taxes, said Shawnee County counselor Jim Crowl.

Overland Park-based Valbridge Property Advisors, working as a third-party appraiser for Shawnee County, appraised the property's value at $9.05 million in a report it provided last February to the county.

Payne contends the property's fair market value is close to the $2.4 million he paid to buy the racing facility.

Shawnee County commissioners said Thursday that Payne hasn't availed himself of the options available for challenging Heartland Park's valuations.

They said he hasn't appealed or protested the valuations for the Heartland Park property for the tax years 2018, 2019, 2020, 2021, 2022 or 2023, meaning the county can't change those valuations.

Shelby Development challenged its property valuations for the 2016 and 2017 tax years, and Shawnee County then entered into an agreement with Shelby Development that set jointly agreed values for the Heartland Park property for the tax years 2016, 2017 and 2018, the county said in its statement Thursday.

"The property taxes assessed are based upon valuations of the Heartland Motorsports Park to which Shelby agreed for those years," it said. "Since that time, no process to invoke a valuation review or a property tax appeal process has been sought by the taxpayer in any future year."

Shelby Development since 2019 has pursued an 11-count lawsuit over its property's appraisal against Shawnee County, its appraiser’s office, appraiser Steve Bauman and assistant appraiser Stacy Berry.

A Shawnee County District Court judge in April 2022 granted summary judgment in the county's favor on all 11 counts. A summary judgment is a determination made by a court without a full trial.

Shelby Development in May 2022 filed an appeal seeking to overturn that dismissal. The appellate case was argued in court on April 11, with a decision being anticipated between late June and late August, Crowl said.

David Holstead, an attorney representing Shelby Development, suggested a proposed settlement of its suit in an April 20 letter to Crowl, who replied by saying state law banned the county from accepting it.

Payne said his proposal would have arranged for Shelby Development to pay the county a collective amount of more than $1 million of the more than $2.6 million owed while Crowl indicated in a letter to Holstead that it would have instead arranged for the company to pay $877,822.95.

Saying "this is in no way a bluff or a threat," Holstead's letter said Shelby Development would close, scrap, and abandon the facility — once it meets its contractual commitments for 2023 — if no settlement were reached.

Payne would then accept "the loss of the undepreciated basis in the property, which (he) has determined will be substantially less than the sum of the currently assessed taxes and penalties," that letter said.

Heartland Motorsports Park originally opened in 1989. The track went through a $15 million renovation in 2003. After being closed in 2015, the track was purchased at the beginning of 2016 revitalized to its former glory.