Pro Stock drag racing regularly faces criticism for being predictable despite its close competition. Fans argue the class feels stale because it is dominated by Camaro‑themed cars with little variety.

Once, racers could choose makes such as Dodge, Oldsmobile, Plymouth or Pontiac. Now, OEMs control licensing and limit creativity, leaving essentially only one brand in the mix. Sure, there’s an occasional Mustang or Dart, but those are few and far between.

The automotive landscape has shifted dramatically since Pro Stock’s debut in 1971. In the first 50 years, the American OEM’s provided 84 different models in competition.

Chevrolet ended its production of the Camaro at the end of 2023, and the Malibu at the end of 2024, leaving only the Corvette, which was never legal for the class. The manufacturer made the bold move toward electric and SUV models.

Chrysler, now Stellantis, production of the Challenger and Charger ended in 2023 as the company transitions to electric muscle cars. It’s not as if the Challenger or a Charger were ever a consideration in NHRA Pro Stock. That’s what it looks like when an OEM has no interest in an arena.

Ford will continue building the Mustang and a new Taurus, but few other coupes or sedans exist.

Richard Freeman, who fields more Pro Stock entries than any other team owner, told CompetitionPlus.com earlier this year that the Camaro’s dominance is a byproduct of aerodynamics, not favoritism. “If there were other body styles that performed better than the Camaro in terms of airflow, they’d likely be on every other car out there,” Freeman says.

In other words, there are likely no new body styles coming into Pro Stock for the next seven years when the age-old body style rule, which has apparently since floated out of the rulebook along with the matching engine regulation.

There’s not much inspiration for OEMs to get involved in Pro Stock these days. The engines aren’t what they sell, and the bodies are just a shell of their original inspiration. But, that’s what the OEMs (and racers) wanted, and NHRA gave it to them.

This has led me to suggest a possible solution: converting Pro Stock into a class featuring full‑size production trucks or SUVs with unaltered bodies powered by 800‑cubic‑inch engines. Such a move might be the only way to gain meaningful OEM participation.

No one else is making this proposal. The racers and stakeholders I spoke with believe Pro Stock should remain as it is.

Bob Tasca III, Ford dealership owner and grandson of the man who coined “win on Sunday, sell on Monday,” says the motto survives in a different way today. “You can’t buy a Funny Car, you can’t buy a Pro Stock car in the showroom,” Tasca says.

He rejects fundamentally overhauling the class. “To change the class that fundamentally … you’re chasing a ghost,” Tasca said, calling Pro Stock “rocket science on steroids.”

Remember one thing about Tasca: he may never have raced the class, but he indeed once held a Pro Stock license. I witnessed his passion for Pro Stock firsthand as we went through the same drag racing school class.

While some fans don’t appreciate its precision, Tasca argues die‑hard followers understand the effort required to win. He believes those fans value what makes the class unique.

Freeman says manufacturer support is the real (and potentially only) issue with Pro Stock. “The only manufacturer that ever really spent any money was GM,” he says. He points out that participation and parity are stronger than ever. “As of right now, our class as far as participants and damn sure parity is the best it’s ever been in the history of the class.”

Greg Anderson, the current series champion, said he would step away if the class converted to trucks or SUVs. “I’m pretty sure anything I step out of that’ll be different, I probably won’t do as well,” he said.

Anderson acknowledged that no one has a clear solution to bring OEMs back. “We’re no closer today than we were two years ago,” he said.

A former Detroit executive also doubted the idea would gain traction, noting that Pro Stock Truck once had strong fields and parity but was still eliminated. He said a switch to trucks or SUVs is unlikely to solve the problem.

He compared modern Pro Stock to Top Fuel dragster: standardized, generic, and highly engineered. Without new OEM money, the category’s appeal for outside investment remains limited.

Drawing from an earlier commentary, there isn’t anything wrong with Pro Stock as it stands. The class delivers close, regulated, naturally aspirated racing that has a dedicated fan base.

RELATED ARTICLE – WHAT’S WRONG WITH PRO STOCK? NOT A THING

Legends like Bob Glidden, Bill “Grumpy” Jenkins, Lee Shepherd, and Warren Johnson built the foundation. Racers like Greg Anderson continue to carry that legacy forward.

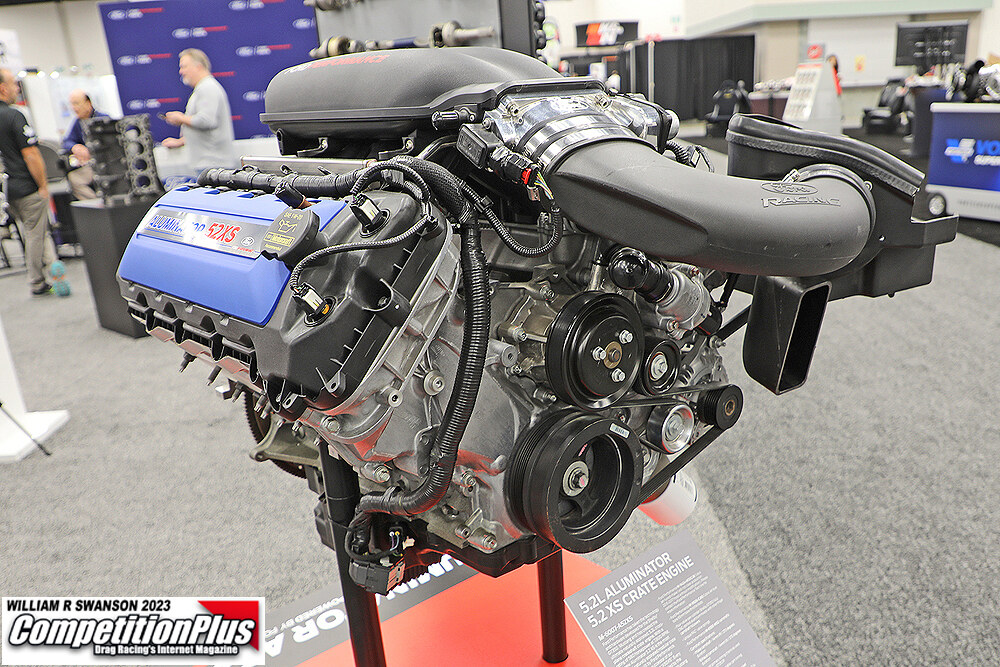

Pro Stock thrives on precision tuning with 500-cid V8s, Liberty transmissions, and engines producing over 1,500 hp at 10,500 rpm.

The idea of converting to full‑size trucks or SUVs is my suggestion to draw interest from OEMs, who currently have few sedans or coupes to promote. None of the drivers or insiders I spoke to support the change but I see nothing else to attract OEM participation.

Tasca says chasing OEMs is “chasing a ghost of Christmas past,” but admits the fan ultimately decides what stays relevant. Freeman believes the class is better than ever, and Anderson sees no reason to leave what he has mastered.

My final thought: Pro Stock is not broken. If you appreciate its competitive, technical nature, it remains one of drag racing’s purest forms. If you don’t like it, don’t watch—but don’t ruin it for those who do.